Straight line depreciation example

Example of Straight Line Depreciation. Salvage Value 2000 3.

Straight Line Depreciation Calculator Straight Lines Calculator Straight

Here is the example of deprecation expenses charged based on the straight-line depreciation method.

. As 500 calculated above represents the depreciation cost for 12 months it has been reduced to 6 months. They have estimated the machines useful life to be eight years with a salvage value of 2000. A company bought some equipment new machine and now wants to calculate the straight-line depreciation of that machine.

Below weve provided you with some straight line depreciation examples. Annual depreciation is calculated as the cost of an asset divided by its useful life. Jim purchases a tractor for his ranch.

Straight Line Depreciation Example. According to management the fixed assets. Suppose a business has bought a machine for 10000.

Now as per the straight-line method of depreciation. The following formula is used to calculate depreciation under straight line method. Lets say a coffee shop purchased a new espresso machine.

Price of acquiring the printer 500 - approximate salvage value. The business uses the following formula to calculate the straight-line depreciation of the printer. Example of Straight Line Depreciation Method.

It has an estimated salvage value of 10000 and. Depreciation expense for the year ended 30 June 2013. The formula to calculate annual depreciation using the straight-line method is cost salvage value useful life.

Has purchased 2 assets costing 500000 and 700000. 500 x 612 250. For example the company just purchased a car for admin staff use cost 55000 USD.

To illustrate this we assume a company to have purchased equipment on January 1 2014 for 15000. In this case the truck was purchased for 25000 and has a useful life of 5 years. The straight-line depreciation method is an accounting method that equally divides the usable equipment value over the course of its usable life to determine the annual.

Cost of the asset 10000 2. Applied to this example annual depreciation would be. Now lets consider a full example of a finance lease to illustrate straight-line depreciation expense.

The salvage value of asset 1 is 5000 and of asset 2 is. Purchase price and other costs that are necessary to bring assets to be ready to use. Straight Line Depreciation Example Lets say for instance that a hypothetical company has just invested 1 million into long-term fixed assets.

Example of straight-line depreciation without the salvage value. The DDB rate of depreciation is twice the straight-line method. You then find the year-one.

Pensive Corporation purchases the Procrastinator Deluxe machine for 60000. Total Depreciation Cost Cost of asset Salvage Va See more. The asset cost is 5000 and it has an estimated salvage value of 2000.

The Eastern company provides the following information regarding one of. Straight-line depreciation with a finance lease. In year one you multiply the cost or beginning book value by 50.

Example of Straight Line Depreciation. Depreciation Expense Cost Salvage ValueUseful life.

Overhead Recovery Rate Calculator Double Entry Bookkeeping Overhead Recovery Excel Spreadsheets

Depreciation Of Fixed Assets In Your Accounts Marketing Process Accounting Small Business Office

How Do I Create A Clear Checklist Template In Excel Download This Well Structured To Do Checklist Xlsx Spre To Do Checklist Excel Templates Checklist Template

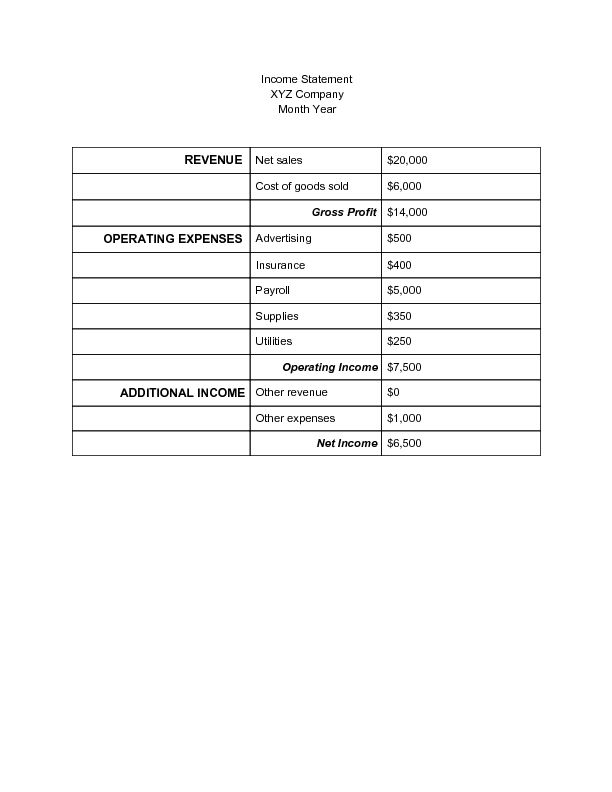

Income Statement Template Income Statement Statement Template Income

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Cash Flow Statement Templates

Methods Of Depreciation Learn Accounting Method Accounting And Finance

Fa 36 Module 8 Video 2 Straight Line Depreciation Problem 8 2a Part 1 Youtube Bell Work Capital Assets How To Become

Straight Line Depreciation Schedule Calculator Double Entry Bookkeeping Bookkeeping Templates Accounting Basics Learn Accounting

Depreciation Journal Entry Step By Step Examples Journal Entries Accounting Basics Accounting And Finance

Depreciation Cost Residual Value Useful Life Depreciation Book Value X Depreciation Rat Business Tax Deductions Business Tax Accounting Principles

Download Projected Income Statement Excel Template Exceldatapro Statement Template Excel Templates Income Statement

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

Depreciation Schedule Template Examples Geneevarojr

Free Invoice Template For Uk Limited Companies Invoice Template Templates Words

Depreciation In Excel Excel Tutorials Microsoft Excel Tutorial Excel Shortcuts

Declining Balance Depreciation Calculator Double Entry Bookkeeping Calculator Bookkeeping Accounting And Finance

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Computer Generation Excel